Good Morning. U.S. stocks climbed on Wednesday amid optimism over easing U.S.-China trade tensions and reassurance from Donald Trump that he doesn’t plan to fire Federal Reserve Chair Jerome Powell. All three indexes marked two-day winning streaks.

Investor sentiment was boosted after Trump signaled a willingness to lower steep tariffs on Chinese goods and adopt a softer tone in trade talks. Treasury Secretary Scott Bessent echoed the optimism, suggesting a “big deal” could be made with China. Trump also dialed back recent criticism of Fed Chair Powell, saying he has “no intention” of firing him, a reversal from recent harsh remarks. This added to market relief and boosted confidence.

Today, we hit on two important topics: the changing stablecoin environment and the next phase of maturation for bitcoin. Check both of those out below. And lastly, while bitcoin may or may not be the future, everyone should know something about its history. Look to see the latest anniversary of bitcoin’s origin in the media section.

The Coming Collision: How Digital Tokens Could Transform U.S. Banking

With the much more open US administration, digital assets are knocking on the door of the American banking system and this time, they might finally be allowed in. Following years of regulatory pushback, a wave of bankruptcies, and the collapse of crypto-friendly banks like Silvergate and Signature, Washington is now signaling a shift to a much more crypto friendly regulatory environment. Under the Trump administration, which has embraced a vision of the U.S. as a “bitcoin superpower,” crypto firms like Circle, BitGo, Coinbase, and Paxos are preparing to apply for banking licenses and charters. The implications could be quite dramatic, not only for the crypto industry, but for the architecture of American banking.

Although much of the progress in regulating the digital asset space is not getting front page coverage, there are a number of bills moving through Congress to establish a framework for stablecoins, cryptocurrencies pegged to the U.S. dollar and backed by cash or Treasury reserves. This would, for the first time, require issuers to be licensed entities, effectively integrating stablecoins into the core of the banking system.

BitGo, a major crypto custodian, is expected to file for a bank charter soon. It is already safeguarding reserves for the Trump-linked stablecoin USD1, part of a broader initiative to create a state-backed presence in the stablecoin market. Anchorage Digital, the only crypto firm with a federal bank charter so far, has already spent tens of millions complying with the same rules that apply to traditional financial institutions. It has partnered with Wall Street names like Cantor Fitzgerald and BlackRock, indicating that the distance between crypto and legacy finance is shrinking by the day.

At the same time, traditional banks are reversing course. Bank of America has hinted at launching a stablecoin if a clear legal path emerges. U.S. Bancorp is reviving its crypto custody business through a partnership with NYDIG. And a consortium of global banks including Deutsche Bank and Standard Chartered is exploring expansion into the U.S. crypto sector. In short, crypto is rapidly moving into the regulated areas of the US banking system and it’s bringing new rules, new infrastructure, and new possibilities with it.

But what might this look like in practice? And how will consumers be impacted? Below we explore some ideas that might be on the horizon.

Scenario 1: Stablecoins as a New Checking Account

In a world where regulated stablecoins are issued by banks or bank-like institutions, consumers could begin using them the way they currently use checking accounts. Imagine payroll being deposited in USD Coin, or monthly rent payments made in a token that settles instantly and has programmable features like expiration dates or automated compliance checks. This could reduce settlement times, eliminate overdraft fees, and cut transaction costs—particularly for underserved communities who are often hit hardest by traditional banking fees.

Scenario 2: Tokenized Deposits and On-Chain Lending

Banks with crypto charters could start offering tokenized versions of traditional deposits. These tokens would be redeemable 1:1 for dollars but could circulate on blockchain rails, allowing users to engage with DeFi-style applications while staying under the protective umbrella of FDIC-insured institutions. This hybrid model might allow banks to participate in decentralized lending protocols or launch their own, giving consumers access to yields that outperform traditional savings accounts—all while remaining within the regulatory perimeter.

Scenario 3: Consolidation and Competition

While the barriers to entry in banking are high, the emergence of crypto-native banks would likely pressure traditional institutions to modernize. We could see a new crop of nimble, tech-first banks that specialize in asset tokenization, instant lending, or cross-border payments—services that incumbent banks have long struggled to offer competitively. This could spark a new era of competition, benefiting consumers with better products, faster service, and more inclusive financial access.

As always, with new technology, comes new risks. Cybersecurity will become much more important, as decentralized money can move from wallet to wallet. Consumers will need education and protections to navigate this evolving system. Regulators will need vigilance and adaptability. And banks, both new and old, will need to rethink what it means to be a financial institution in a world where dollars no longer live in ledgers but move freely on-chain.

Bitcoin’s Break from Stocks: A Sign of What’s to Come?

As we have seen in recent weeks, in times of market turmoil, the selling can hit all liquid markets. Since its founding, Bitcoin has been seen by many as a technology play and can sell-off in tandem when the NASDAQ sells off. Recently, we have noticed something notable in how assets are trading. While the S&P 500 is down 3.5% over the past week and concerns around U.S. monetary stability mount, Bitcoin has risen over 6%. Gold, long considered a safe haven, has surged to a record high of $3,500, making it one of the top-performing asset classes this year. Together, these moves hint at a potential shift in investor behavior—and perhaps something deeper about the global monetary order.

Historically, Bitcoin has shown high beta to risk markets. When the Nasdaq fell, Bitcoin usually fell harder. In March 2020, as COVID panic gripped markets, Bitcoin crashed over 50% in a matter of days. The same pattern played out during the 2022 inflation shock and rate hike cycle. Investors, needing liquidity, sold what they could, including crypto. But now, the dynamics may be shifting.

Several factors are contributing to Bitcoin’s apparent decoupling from equities. First is the growing lack of faith in the U.S. dollar. The DXY index, which tracks the greenback against a basket of other major currencies, has declined sharply this month. Meanwhile, rhetoric from the U.S. administration—ranging from threats to remove Fed Chair Jerome Powell to escalating trade wars, has only deepened fears of policy instability. Investors are looking for alternatives, and for many, Bitcoin is starting to stand out not just as a speculative tech asset, but as a monetary alternative.

That distinction matters. Gold’s performance is already signaling a flight from fiat. But gold is not new, and it’s not programmable. Bitcoin, by contrast, is digital, decentralized, and most importantly, capped at 21 million coins. In an environment where fiscal discipline is scarce and debt continues to balloon, assets that cannot be debased take on new importance.

The larger narrative at play here is about the role of the U.S. dollar as the global reserve currency. For decades, the dollar’s dominance has allowed the U.S. to finance deficits cheaply and exert global economic influence. There seem to be cracks forming. Geopolitical realignments, de-dollarization efforts in parts of Asia and the Middle East, and central bank gold purchases all reflect a desire for alternatives. If this trend accelerates, and especially if the dollar’s credibility continues to erode, Bitcoin could become an increasingly relevant asset in the global reserve conversation.

Skeptics will rightly point out that Bitcoin is still young, volatile, and lacks the liquidity or legal infrastructure that sovereigns demand. But institutions are already circling. ETFs like the CoinShares Valkyrie Bitcoin Fund (BRRR) are providing new, regulated ways for investors to gain exposure. Major custodians like Fidelity, Coinbase, and BitGo are building infrastructure that rivals what exists for traditional financial products. The foundations are quietly being laid.

What we may be witnessing is a maturation moment for Bitcoin. Not just as a store of value, but as a hedge against systemic fragility. If markets are, in fact, pricing in the beginning of the end of dollar supremacy, then it’s no surprise that Bitcoin is starting to behave differently. The next time stocks sell off, we might start to see this being a buy signal for Bitcoin.

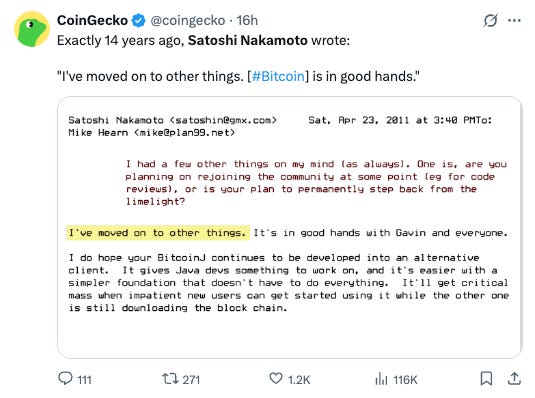

Media of the Week: 14 Years Ago…

Exactly 14 years ago yesterday, the famous Satoshi Nakamoto wrote in the famous emails, “I’ve moved on to other things. It (Bitcoin) is in good hands.” And boy oh boy have things changed from 14 years when it was priced at approximately $4.25.

I genuinely believe the U.S. will move forward with it—if China does it first. Not because it's the right thing to do, but because we’re locked in yet another global measuring contest, as usual.

What concerns me is that somewhere along the way, we stopped doing things for the greater good of “the people.” That spirit of collective progress we saw in the late '90s—when innovation was booming with purpose—feels like it’s been replaced with reactionary policies and competitive posturing.

Imagine the possibilities if we led with intention, not ego. It’s time we realign our motivations.