Good Morning. U.S. stock markets rose modestly in choppy trading as the Federal Reserve held interest rates steady but warned of rising risks to both inflation and unemployment. The Fed emphasized growing concerns over economic slowdown and inflation, particularly due to rising global trade tensions and proposed tariffs. Fed Chair Jerome Powell warned that current tariff policies could dampen growth and push up inflation, suggesting the central bank will remain cautious on rate cuts.

Markets also reacted to a Bloomberg report that the Trump administration may lift Biden-era AI chip restrictions, pushing Nvidia shares up 3%. Crypto continues to go on a bit of a bull run as both Bitcoin and gold climb higher every day.

Today, we discuss how VCs are rapidly involving to a different type of private equity financial architecture utilizing crypto. Check it out. And XX

Crypto News You Can’t Miss: How Crypto Is Changing Venture

Venture capital is rapidly evolving from a high-risk, early-stage investment model into a broader, more powerful financial architecture that resembles private equity and institutional asset management. Leading firms like Lightspeed, Sequoia, Andreessen Horowitz, and Thrive Capital are becoming Registered Investment Advisors (RIAs), allowing them greater flexibility to invest across asset classes, hold long-term positions, and engage in secondary markets and buyouts. This shift is driven by the decline in IPOs and acquisitions, and a growing need for liquidity solutions in an environment where startups stay private longer.

To solve the liquidity bottleneck, these firms are embracing tokenization—using blockchain technology to fractionalize equity, enable programmable ownership, and create real-time secondary markets. This approach aligns with the digital economy and offers more dynamic, transparent ownership structures. Andreessen Horowitz’s early move into crypto now appears visionary, as token networks provide the infrastructure for long-term control and alternative liquidity paths.

Although regulatory challenges remain, the momentum is clear: the lines between venture capital, private equity, and digital assets are blurring. The future of venture lies not in the stage of investment but in how firms manage and unlock value—”marking a shift from access to architecture in modern finance.”

Arabian Nights 2.0

The BIR was well represented at the TOKEN2049 in Dubai which is the key crypto conference of the Middle East. The big news was the traditional finance players who normally skip these events were there in force. Over a few jam-packed days, more than 15,000 industry leaders, developers, investors, and policymakers descended on Madinat Jumeirah to witness a shift that has been building for years. From billion-dollar stablecoin deals and Bitcoin-native protocols to AI-powered smart agents and next-gen custody solutions, the message was loud and clear, crypto is more than Bitcoin. And Dubai showed that it is increasingly playing a much bigger role in this space.

Across meetings, side events, and headline panels, one theme dominated: the merging of traditional finance with crypto-native infrastructure. BlackRock, VanEck, Apollo, and other TradFi giants didn’t just send teams, they headlined many of the talks and panels. Discussions around tokenized funds, stablecoin-settled assets, and real-time, 24/7 trading weren’t speculative anymore. They were product roadmaps. One line that I thought summed it up, “Tokenization is not an experiment. It’s an inevitability.”

Behind the scenes, asset managers are preparing for a generational shift. Think tokenized U.S. Treasuries, real estate portfolios, private credit vehicles, all executed on public blockchains with programmable compliance. The push isn’t to abandon Wall Street, but to rebuild its infrastructure with code.

Meanwhile, startups are rushing to fill the gaps. Modular blockchains and app-specific networks are rising fast, offering performance Ethereum has struggled to deliver. Projects are chasing Solana-like speeds or building entirely new architectures like Berachain or Monad. Ethereum’s place at the top still holds, but the ground beneath it is shifting.

AI also took center stage, not as hype, but as integrated tooling. Teams demoed autonomous trading agents, decentralized compute platforms, and AI-enabled security monitors that can respond to threats in real time. Crypto and AI are increasingly intertwined, with one powering markets and the other orchestrating logic.

Gaming remains crypto’s most reliable onboarding engine. No longer chasing ponzi-style play-to-earn loops, developers are building more sophisticated economies. Players can now own interoperable items, earn real value, and trade across platforms with no KYC required. The user acquisition strategy is simple: make great games, and let Web3 handle the rest.

And then there’s the money. Stablecoins like USDC and USD1 took a starring role, not just for trading pairs but as infrastructure for billion-dollar investments. The most talked-about moment may have been the announcement of a $2 billion stablecoin-based investment into Binance, the largest of its kind. For economies with unstable currencies, these dollar-pegged tokens are quickly becoming indispensable tools.

TOKEN2049 Dubai was less a bet on the future but rather felt like a blueprint. Whether it’s smart agents managing DAOs, sovereign funds exploring stablecoin rails, or chatter around large M+A deals in the works, there was a lot of energy in Dubai.

Media of the Week: Bullish or Bearish?

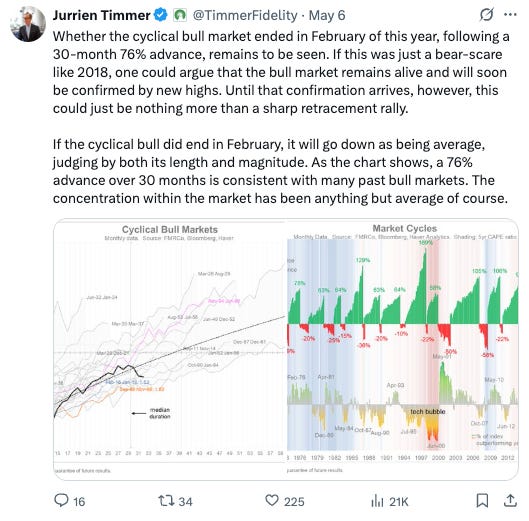

As the trade wars continue to stir up the world order and the future seems a bit murky, we can look towards the past for any similarities. 2018 saw a similar pullback, whether history repeats itself remains to be seen. How do you feel: bearish or bullish?